CARTAXPRO: Cash or Company Car?

We explore giving up the perk ....

Cash or Company Car?

28 July 2020

Have you been offered the choice between a cash allowance and a company car?

We explain how to make the right choice.

It's A Perk Jim, But Not As We know It ...

Company cars have been amongst the top perks employers can offer to recruit and retain staff ever since new tax rules were introduced long ago in 1976 in order to simplify the tax treatment.

But recently there's been a growing trend for employees to take a cash allowance instead of a company car, either for lifestyle or cost reasons.

In the current COVID-19 crisis, with both business and personal travel curtailed for many, swapping between a company car and a cash alternative could be a viable option next time your company car is renewed.

So how do you go about weighing up the perk options of a company car or a cash allowance instead?

We'll take you through the key decision breakers and point you towards a tool which can do all the complex mathematics for you.

Where To Start?

It may seem obvious, but the first thing that you need to know is 'How much?'.

And that includes:

- The type of alternative you will get.

- How the cash is calculated.

- What the cash will cover.

- How the cash will be delivered.

Why is all that important?

Well, that's because, when you switch to cash instead of a company car, you'll have costs for:

- Financing your next car

- Depreciation

- Servicing and maintenance, plus breakdown cover

- Insurance (not just for accident damage but possibly also for finance repayments, tyres, etc)

- Fuel

- Tax and national insurance on your allowance

One way or another your cash allowance will have to cover all of the above costs, otherwise you're going to be out of pocket.

What Type of Allowance?

Your employer may not deliver the cash you need in a straighforward manner to enable you to easily check the condition of your wallet after taking the cash.

Some quite sophisticated methods of delivery have been developed in the 30 years since cash alternatives began to appear.

Here are just a few of the ways you could be paid to give up your company car:

- Monthly allowance only

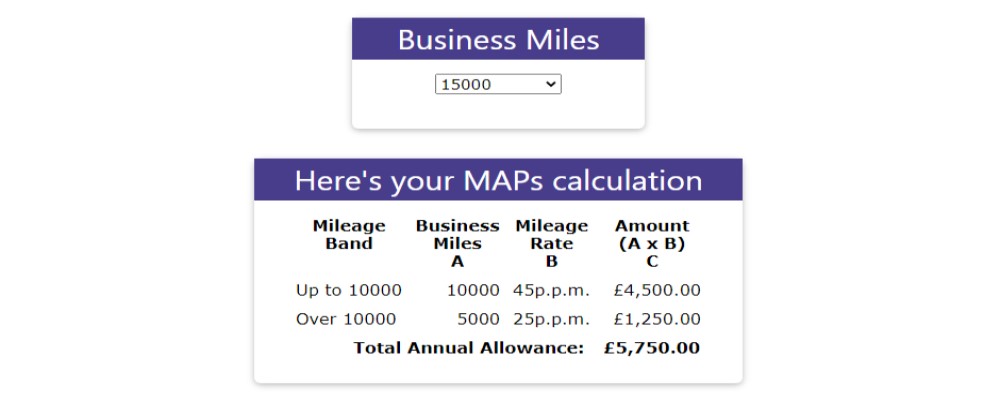

- Monthly allowance and mileage allowance for business travel

- Monthly allowance and fuel reimbursement

- Monthly allowance and fuel card

- Mileage allowance for business travel only

And there are derivatives of all the above to consider as well.

For example, on the one hand your employer may pay a flat rate monthly allowance and a business mileage allowance, and compensate you for any extra taxes you have to pay on the cash allowance compared to a company car.

That's great, your employer is making sure you don't lose out when moving to a cash allowance.

On the other hand though, your employer may instead just pay a monthly cash allowance and reimburse business fuel costs, then expect you to pick up any changes in taxes in return for the freedom to choose any car you like (rather than be restricted to the choice list in your company car policy).

Either way, you need to scrutinise the proposed cash allowance arrangements quite carefully.

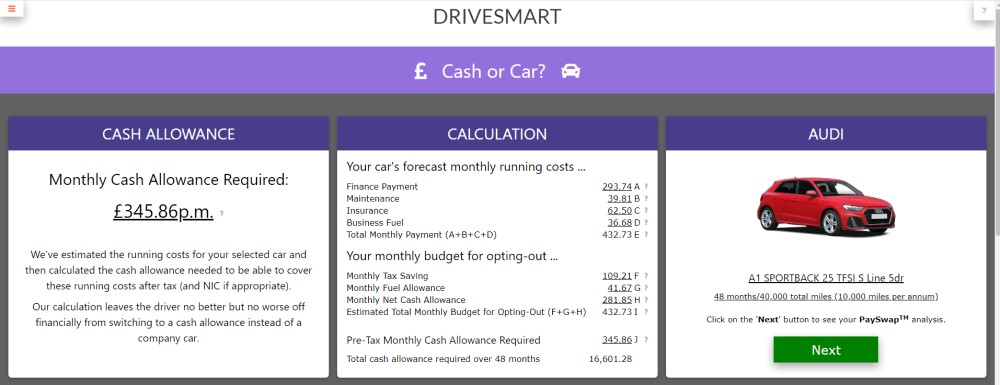

Fortunately we have a calculator that will do the hard work for you.

If you need to check your cash allowance, or a combination of allowance and mileage reimbursement or fuel card, or if you just want to see how much you would need to enable you to give up your current company car, click on this link.

Meanwhile ...

We've produced a guide to working out whether you win or lose from a cash allowance, so click here to read on.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

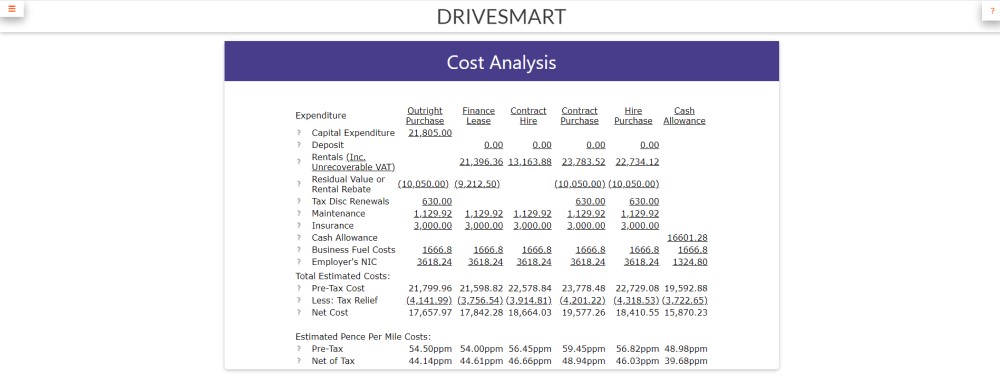

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.