CARTAXPRO: Cash Allowance

Will you win or lose from taking cash instead of a company car?

Cash Allowance - Win or Lose?

4 August 2020

You've been offered a cash allowance or a company car; how do you win?

We explain how to avoid a cash allowance costing you money.

Why?

There are typically two key reasons for an employer implementing a cash alternative to company cars;

- cost savings compared to providing company cars; and/or

- improved offerings for recruiting/retaining staff.

Whatever your employer's reasons, it would be understandable if all you're really concerned about is whether you will win or lose from a cash allowance or opt-out deal.

And you could win by your employer offering you a cash allowance that's generous and leaves you financially better off.

Or you could win just by getting a car that's closer to your requirements than the standard offering on the company car choice list.

But you could also lose if your employer's cash allowance does neither of the above for you.

So, you need to test the maths to work out whether you win - either from a cost perspective, or from getting a more suitable car from your cash allowance - or if you lose, and you therefore need to negotiate with your employer.

Start With Your Costs

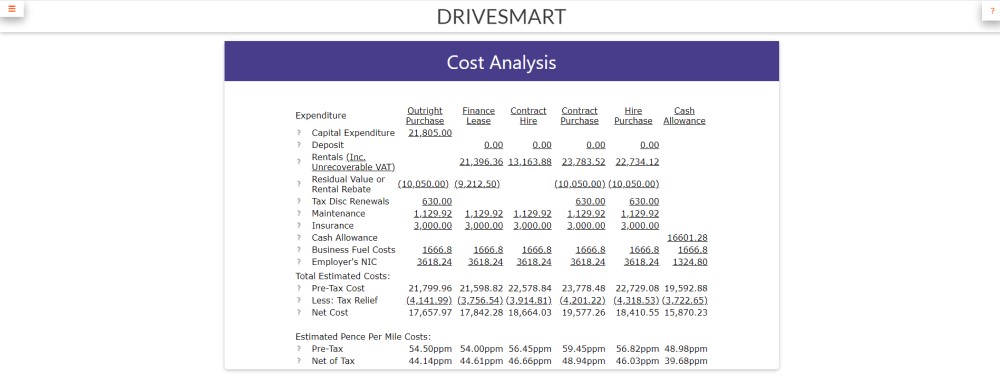

To get started you need to focus on the maths surrounding your car's running costs. You will need to:

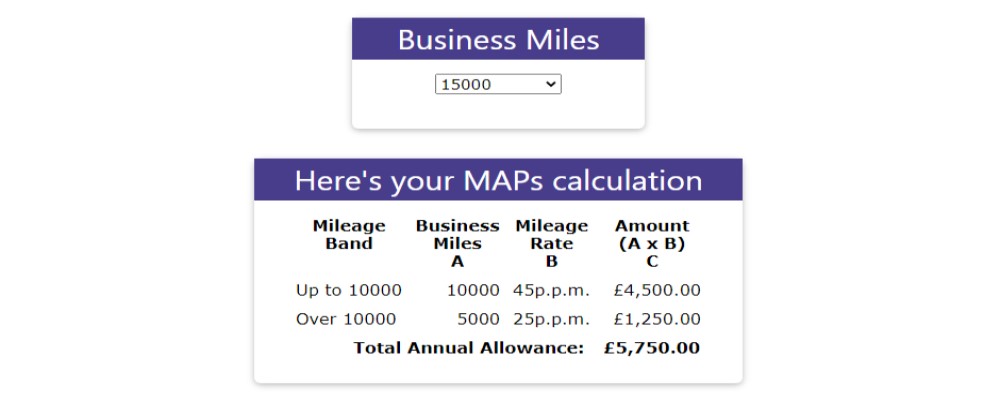

- Estimate the total mileage you will travel each year and the business proportion of this.

- Calculate the tax relief you will get on the business mileage.

- Work out your net monthly cash allowance (including any mileage allowance or fuel cost reimbursement) after tax and NIC, taking account of the tax relief for business motoring.

- Add back the tax you would have paid on a company car

- Calculate the running costs for the car you want

- Compare the net cash allowance/mileage allowance and company car tax saving to your running costs for the car.

- Sit back and smile or cry according to the results.

OK, we're being a bit flippant with the last one, but it's important that you make a cash alternative work for you, not just your employer.

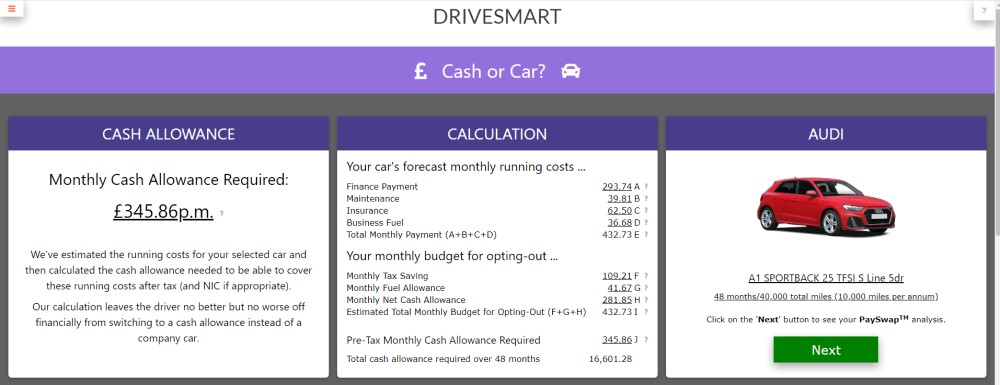

But don't worry, you can take a short cut through all of the maths involved with our 'cash or car' calculator; it's called PaySwaptm and clicking on this link will take you to it.

PaySwaptm will do all the maths for you, irrespective of whether you know how much cash you will get.

PaySwaptm will also show you cars you can get for the money you've been offered and work out if the car you want is affordable.

And once you've done the maths, you're ready to start the next phase; paperwork ....

Get It In Writing

The old adage "the job's not over 'till the paperwork's done" could not be more apt than when it comes to taking a cash allowance instead of a company car.

You will need to read carefully your employer's terms and conditions for the cash allowance, for example:

- What is it intended to do?

- What does it cover?

- Exactly how much will you get?

- Is it pensionable or eligible for overtime or other pay related benefits?

- What are your rights if arrangements leave you out of pocket?

- Once you've left the company car plan can you return to it?

- What happens if you leave your employment through redundancy or getting a new job?

This list isn't exhaustive, but you get the idea, and a word with your professional advisers/employee representatives, etc, may well be worthwhile.

Irrespective of whether or not your employer is assisting with the supply of the car or finance/maintenance, read all contractual documentation (car purchase terms, finance agreement etc) thoroughly - it may be painful, but these are usually legal documents and if you don't understand them you probably shouldn't be signing them.

Pay particular attention to:

- The type of contract for the car - is it a lease or purchase agreement (and be careful with leases - these can cause problems with taxation if your employer is involved in setting up the arrangements)

- Any contractually required monthly finance, maintenance, insurance and fuel costs

- Penalties for cancelling agreements early

- Additional costs on completion or termination of any contracts

- Any amounts guaranteed for future car values in PCP or other finance agreements

- Return condition clauses for vehicles (e.g. penalites or excess mileage/wear and tear charges)

- Exclusions from your motor insurance, especially if you carry goods/samples for work

- Items covered/excluded from maintenance and breakdown recovery agreements

Do You Feel Like A Winner?

You've done the maths, checked the paperwork and it all adds up to a win.

That's great, so where to next? Click to read on ...

But if you've lost, don't worry; you now have the ammunition to go back to your employer and challenge their cash allowance proposition.

You know the running costs you will face and the cash allowance you will get. It's time to negotiate.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.